Investments

The U.S. Olympic & Paralympic Endowment maintains a balanced investment policy focused on preserving purchasing power while providing stable, long-term program funding.

The Endowment aims to preserve its purchasing power while providing stable, long-term funding for its programs. It seeks total returns that exceed operating, management, and inflation-related costs, reinvesting all earnings beyond approved expenditures. Guided by UPMIFA standards, the Investment Committee manages a diversified, cost-effective portfolio designed to minimize unnecessary risk and ensure prudent stewardship of assets.

As part of its mission as a supporting organization to the U.S. Olympic & Paralympic Committee (USOPC), the Endowment offers USOPC member and affiliated organizations the opportunity to invest in two pooled investment vehicles.

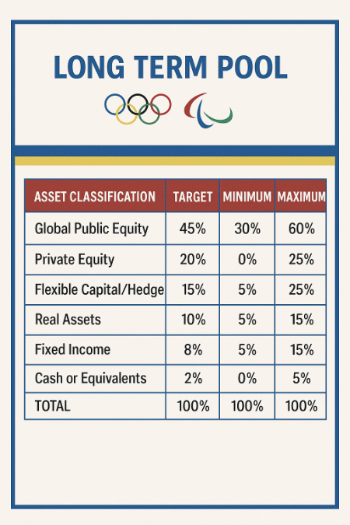

Long Term Pool

THE LONG-TERM POOL is modeled after large university endowments, investing across a diversified portfolio with a long-term horizon, a significant allocation to alternative assets such as private equity and hedge funds, and a focus on generating sustainable returns to support the Olympic and Paralympic community in perpetuity.

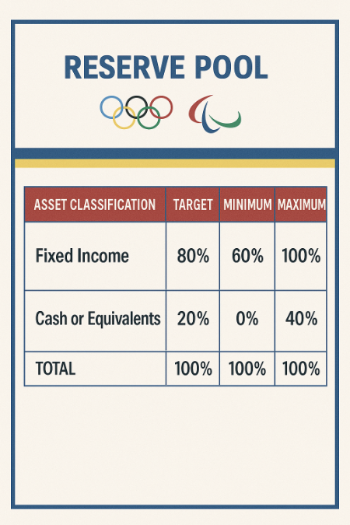

Reserve Pool

THE RESERVE POOL is structured to balance immediate accessibility with long-term stability. It prioritizes principal preservation, maintaining sufficient liquidity to meet near-term funding needs, and achieving reasonable returns that keep pace with inflation—without taking on excessive risk. Unlike the long-term pool, the reserve pool emphasizes stability and flexibility to ensure resources are available when needed to support the Olympic and Paralympic community.